Welcome to Seiersen Enterprises

E

Enjoy our blogs here

Sustainable Supply Chain Value Through the Right Deals with the Right Trading Partners

Digitizing the Supply Chain

Check out my blogs on Linkedin: https://www.linkedin.com/in/nicholasseiersen/recent-activity/articles/

Trust & Trading Relationships

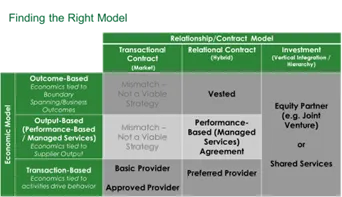

Which Model is Right for Which Deal?

Here we dig in to how to know which model is right for which deal. Each deal can be expected to have its own model, even if it is with the same trading partner.

Use the open-source tool from “Strategic Sourcing in the New Economy[1]” to determine what economic and relational models we want, and this informs how much effort to dedicate to each relationship, based on what is at stake.

Start with which economic model you will be pursuing together. By considering the issues on the right, you will be able to agree whether you are looking for:

An outcome-based deal where the supplier is paid for delivering and outcome like lower repair and return costs, or greater customer retention through more effective call centre calls. Improvements and benefits are obtained jointly and the benefits are shared.

An output-based deal is one where the supplier is paid to produce a good or service at a certain level of quality. If the supplier implements internal improvements, the cost, risk and benefits are theirs. Some output deals have a continuous improvement commitment and a service attainment incentive.

A transactional deal is one where you buy a good or service at an agreed level of quality at an agreed price.

The relationship model comes next. It follows that if you want exceptional results, you will have to invest more into the relationship.

A transactional deal is one where you buy and pay without a great deal of interaction. At its extreme, this is a one-off reverse auction of an undifferentiated product. I think of it as buying a brand name pack of chewing gum from a convenience store. Quality and price are given, and the transaction is complete when you leave the store.

A relational deal is one where the participants align expectations and jointly manage risks and disruptions. They work together in order to improve together.

An investment deal is one where the activity is so important to the buyer that they want control over the intellectual property, the capabilities, the investments, or just the confidential data. They have an ownership interest, either through an in-house shared services organization, or a joint-venture partner.

Using the issue below, you can agree what is the most appropriate relationship model for you to adopt.

Plot the two dimensions on a matrix, to obtain the picture at the top, and you will be able to read the business model that makes sense.

You will note that you cannot achieve outcome or output results with a transactional relationship, so the potential models are 7 instead of the theoretical 9.

Next time we will look at the appropriate practices that each one of the Seven Sourcing Models requires to be most effective, and the swimlane or stack of contracting and commercial management disciplines.

[1] See www.vestedway.com for more information about this and other books and the open source Vested Outsourcing methodology developed at the University of Tennessee.

Data Quality

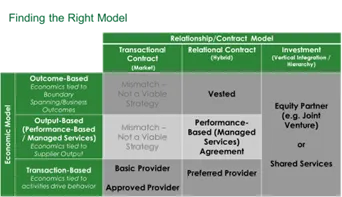

Which Model is Right for Which Deal?

Here we dig in to how to know which model is right for which deal. Each deal can be expected to have its own model, even if it is with the same trading partner.

Use the open-source tool from “Strategic Sourcing in the New Economy[1]” to determine what economic and relational models we want, and this informs how much effort to dedicate to each relationship, based on what is at stake.

Start with which economic model you will be pursuing together. By considering the issues on the right, you will be able to agree whether you are looking for:

An outcome-based deal where the supplier is paid for delivering and outcome like lower repair and return costs, or greater customer retention through more effective call centre calls. Improvements and benefits are obtained jointly and the benefits are shared.

An output-based deal is one where the supplier is paid to produce a good or service at a certain level of quality. If the supplier implements internal improvements, the cost, risk and benefits are theirs. Some output deals have a continuous improvement commitment and a service attainment incentive.

A transactional deal is one where you buy a good or service at an agreed level of quality at an agreed price.

The relationship model comes next. It follows that if you want exceptional results, you will have to invest more into the relationship.

A transactional deal is one where you buy and pay without a great deal of interaction. At its extreme, this is a one-off reverse auction of an undifferentiated product. I think of it as buying a brand name pack of chewing gum from a convenience store. Quality and price are given, and the transaction is complete when you leave the store.

A relational deal is one where the participants align expectations and jointly manage risks and disruptions. They work together in order to improve together.

An investment deal is one where the activity is so important to the buyer that they want control over the intellectual property, the capabilities, the investments, or just the confidential data. They have an ownership interest, either through an in-house shared services organization, or a joint-venture partner.

Using the issue below, you can agree what is the most appropriate relationship model for you to adopt.

Plot the two dimensions on a matrix, to obtain the picture at the top, and you will be able to read the business model that makes sense.

You will note that you cannot achieve outcome or output results with a transactional relationship, so the potential models are 7 instead of the theoretical 9.

Next time we will look at the appropriate practices that each one of the Seven Sourcing Models requires to be most effective, and the swimlane or stack of contracting and commercial management disciplines.

[1] See www.vestedway.com for more information about this and other books and the open source Vested Outsourcing methodology developed at the University of Tennessee.

Other Supply Chain Topics

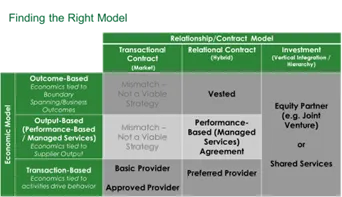

Which Model is Right for Which Deal?

Here we dig in to how to know which model is right for which deal. Each deal can be expected to have its own model, even if it is with the same trading partner.

Use the open-source tool from “Strategic Sourcing in the New Economy[1]” to determine what economic and relational models we want, and this informs how much effort to dedicate to each relationship, based on what is at stake.

Start with which economic model you will be pursuing together. By considering the issues on the right, you will be able to agree whether you are looking for:

An outcome-based deal where the supplier is paid for delivering and outcome like lower repair and return costs, or greater customer retention through more effective call centre calls. Improvements and benefits are obtained jointly and the benefits are shared.

An output-based deal is one where the supplier is paid to produce a good or service at a certain level of quality. If the supplier implements internal improvements, the cost, risk and benefits are theirs. Some output deals have a continuous improvement commitment and a service attainment incentive.

A transactional deal is one where you buy a good or service at an agreed level of quality at an agreed price.

The relationship model comes next. It follows that if you want exceptional results, you will have to invest more into the relationship.

A transactional deal is one where you buy and pay without a great deal of interaction. At its extreme, this is a one-off reverse auction of an undifferentiated product. I think of it as buying a brand name pack of chewing gum from a convenience store. Quality and price are given, and the transaction is complete when you leave the store.

A relational deal is one where the participants align expectations and jointly manage risks and disruptions. They work together in order to improve together.

An investment deal is one where the activity is so important to the buyer that they want control over the intellectual property, the capabilities, the investments, or just the confidential data. They have an ownership interest, either through an in-house shared services organization, or a joint-venture partner.

Using the issue below, you can agree what is the most appropriate relationship model for you to adopt.

Plot the two dimensions on a matrix, to obtain the picture at the top, and you will be able to read the business model that makes sense.

You will note that you cannot achieve outcome or output results with a transactional relationship, so the potential models are 7 instead of the theoretical 9.

Next time we will look at the appropriate practices that each one of the Seven Sourcing Models requires to be most effective, and the swimlane or stack of contracting and commercial management disciplines.

[1] See www.vestedway.com for more information about this and other books and the open source Vested Outsourcing methodology developed at the University of Tennessee.

Office: Sidney, BC

Canada

Call 647-299-8360

Email:nick@seierseninc.com

Site: www.seierseninc.com